The underlying weak state of the eurozone persists for the reasons explained in full in the blog.

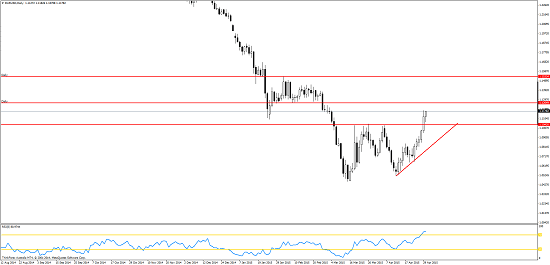

EURNZD

This has been on our live list and now on our re-entry list! For reasons given above we were looking for a pullback to 1.4544 for another short position. After the rally this week , we are now watching 1.4775 to see how it behaves

There are many mixed signals here as the New Zealand Reserve bank have indicated an easing policy which will weaken the currency. However the underlyings and the rate differential still favour the short. We will review this next week.

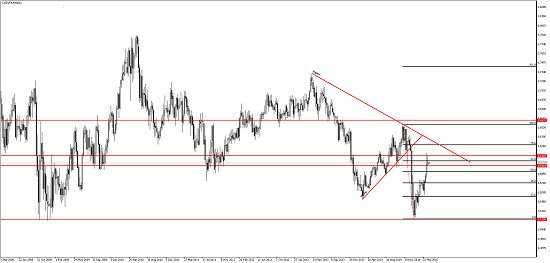

EURUSD

We had a pending sell order at 1.10. We cancelled this before the FOMC for obvious reasons! . Again the weakness of the Euro and the relative upbeat comments of the FOMC make this an attractive short but one we have to wait patiently for and choose the right level. We will see how this one reacts at 1.1264. The correction is not over until it is over!!

EURCAD

Interesting pair. We were planning to fade the range at 1.3370.with a tight stop as it presented a strong pullback. The Cad has shown recent strength due in part to a rally in oil and a more positive spin from the BOC. Again this week the Euro has rallied strongly and has been supported by some improving data. We therefore shifted focus to a higher level of resistance to wait for a short at 1.3550. Again it is not a question of simply jumping in at that price but watching for the reaction and waiting for a consolidation and confirmation of a rejection of the level. In these market conditions careful patient trading is required.

It has been a big news week, especially on Wednesday and the two other rate decisions and I will discuss these and their implications in the full blog next week.

Please remember we are not making trading recommendations. These are ideas for practicing and demo accounts!!

Judith Waker

Robbie Stephenson

0 Comments