The strength of the USD was the focus from summer June last year until its high in the first week of March. When that momentum was lost the confusion was born simply because it was the only economy in the global sense that promised a recovery, even if a fragile and rather long-winded one. The recent spate of disappointing data and signs of sluggishness in the ‘pick-up’ have left us with very few options in our choice of pairs and it now seems more a question of comparing weakness than of pitching strength against it.

The bullish sentiment in the USD has no doubt changed down a few gears and with the week ahead containing two major US risk events it is a good week to sit back and wait for the fall out in any of the major pairs.

Once again the stress is on the lack of real change in terms of comparatives and in terms of yield differentials but the environment does not favour those attempting to stack the probability odds and as the May Day bank holiday weekend approaches thinner volumes won’t be helping to ease the situation anytime soon.

The Forex Trader’s Watchlist

FOMC again!

Already the forecasts for the second quarter are being lowered following the recent soft data.

To add to the increasing misses, last week core retail and retail, PPI and a flat CPI.

Inflation optimism is waning but only in so far is it is required to justify an earlier rate remove.

It been postponed in the consensus view, including the bond market, until later this year and an growing number that think that 2016 is becoming much more likely for the launch.

As for GDP, expectations for growth are now pushed back to the third quarter.

Whilst divergent monetary policy in the global context is still the fundamental basis of USD strength and will continue to be so, a lot of that strength has already priced in the first rate hike and that seems to be moving further away. The adjustment is inevitable.

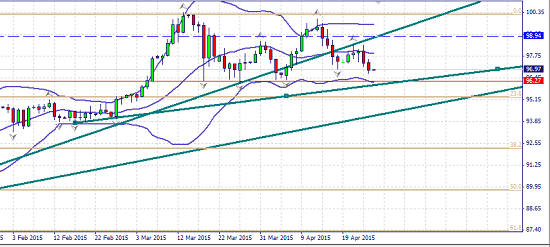

The USD index is a must again to monitor this week and to help predict the strength of the pullback we may expect. The index has closed below the daily 50 EMA indicating room below from the technical perspective. Here is the daily chart showing the weekly fibs;

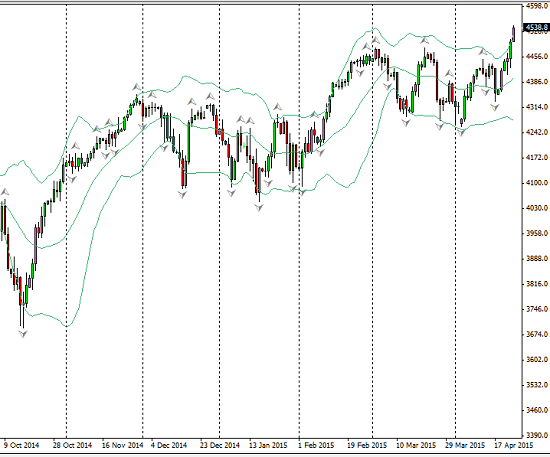

A Strong week in the US equity markets it seems funds are still flowing in;

The S&P on the upper edge of a consolidation was looking bullish on Friday. This driven by the tech sector outweighing the negative effects of those companies feeling the effects of dollar strength, the likes of Proctor and Gamble. The Nasdaq gaining 3.3% was predictably very strong.

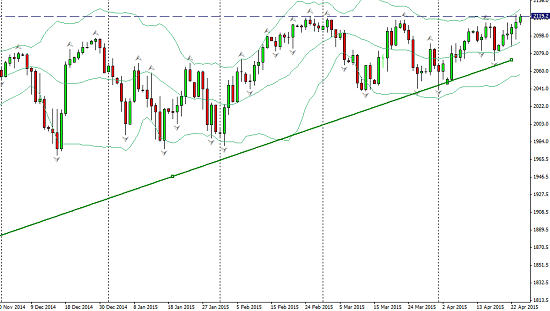

The S&P still in a consolidation triangle is testing the high;

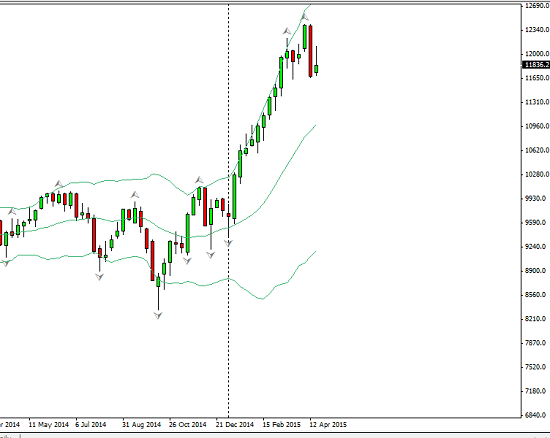

Elsewhere in Japan the Nikkei pushed ahead, but a different story in the Eurozone. Here s the weekly dax;

*Fading the rallies.

Clearly the emphasis continues to be eurozone weakness. Following the Greek saga in itself is filled with contradiction. Greece runs closer each day to bankruptcy funds due to run out within weeks. The pressure builds on the Greek government to give way on some of the reforms required by the Euro troika. There is additional pressure now by way of a threat to readjust the ELA funding by reviewing the value of greek bonds held as collateral. Time and options are narrowing and the news is unreliable, Greek statements indicating progress followed by press releases of conflict .

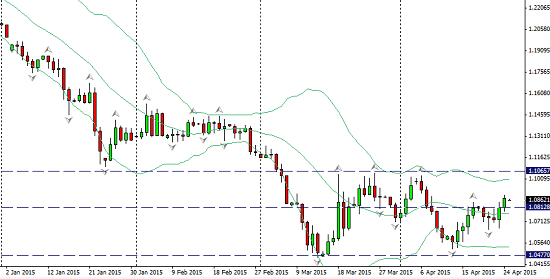

The effect on the Euro is indecision and rallies that fade. The result is ranges both intraday and on larger timeframes.

The daily chart indicates the ’safest’ place to short the Euro. I personally, am only prepared to sell the Euro from the upper side of the range. Fundamentally buying the bottom is not justified. Markets do not like uncertainty and that is the environment that could continue for some time to come.

The data from theEurozone was dissappointing quite apart from the crises in greece. German economic sentiment has fallen. Additionally both German and French PMI missed, with Germany at a precarious 51.9 and France further underwater at 48.4. European CPI next Thursday.

Taken in context of the correcting USD, there may be some selling opportunities at better prices. 1.10 is a level to watch this week, in conjunction with the events calendar.Of course!

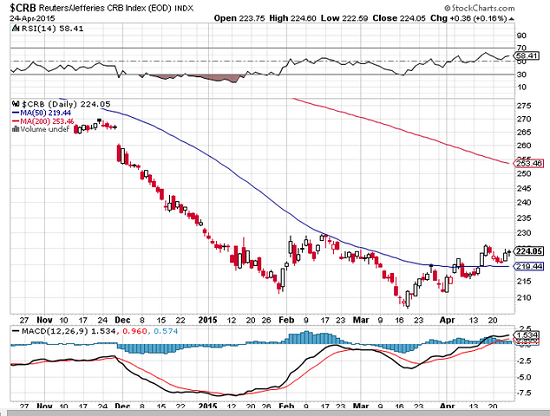

The Commodity Currencies

All had a better time of late with the index looking much stronger.

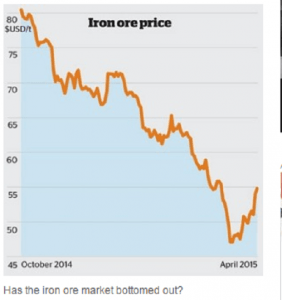

With the Chinese bringing in some liquidity to boost imports of iron ore, the price has risen

However experts in the industry see the upside limited as supply increases and demand still down on a year to year comparison in China. For now the rally assists the Australian economy. How long it can do so it not so clear.

Oil

Sentiment and the Japanese Yen

As we wait for news on the Greek crises the short term risk appetite could well be given a short term boost by an agreement. With the underlying fundamentals and a tricky and certain path ahead it may not last long but risk appetite may continue a while longer if even hope of an interim accord is reached. It does seem to be mutually desired even if the common ground is somewhat narrow.

The consequences of risk appetite not only drives equity markets but does not support Yen trades so beware of the downside risk as the news from the EZ shifts around and as we have seen in different and contradicting directions!

The fact that our markets are complexly interconnected presents other scenarios, also for the Japanese Yen. At home they do not expect any further stimulus at the present time, their yields are improving and even inflation remains close to 2%. Any dovishness or hesitation in the Fed on Wednesday could see strength in the Yen against the Greenback.

Little wonder that confusion abounds. This is why it is so important to understand the drivers not only in the major pairings but the crosses. It is NEVER about one economy even if there is a bias.

With the election strangely taking a back seat as the BOE accent the optimism in the recovery, the GBP could see containuing strength this week. All just a bit precarious however with polls shifting constantly their predictions. The data last week wasn’t strong with retail sales wrongly missing the mark and this week Tuesday gives us preliminary GDP. For me, I have to admit all bets are off!

Watch Wait and maybe take a vacation!

This week presents the double billing from the US on Wednesday. With a rate statement from New Zealand the same day it could be choppy seas again. This is not to mention Euro CPI on Thursday , NZD trade balance (Monday) and another round of PMI’s. This week is not for the faint hearted and it reminds me of an old expression…if in doubt, don’t. If you do, watch the news, keep a lid on risk and take small positions.

Check out my colleague Marc Walton Technical analysis for this week here: Weekly Forex Technical Analysis

Judith Waker

0 Comments

Trackbacks/Pingbacks