Of course the market is waiting with baited breath for the outcome of the Opec meeting in Vienna tomorrow. The US is now on holiday for two days so it is a strange trading week and not a time to be opening positions.

The Outlook For Oil

Opec does not wield the power it once did, neither can it enforce any decisions on its member countries

However it is a market mover and it will no doubt affect market behaviour over the next few days and beyond. Its a geopolitical hot potatoe as well as an ‘economi’ event The analysts are evenly split, but the pre meetings have not gone well. Russia has already confirmed even if Opec cuts it will not, this coming from the CEO of Rosneft, Igor Sechin Russia’s largest producer. Oil fell today on these concerns to a new low .

Opec’s options are cuts substantial enough to halt the drop, a fudge of the whole issue due to lack of any agreement within the membership or a clear decision to leave production as it is. It is not clear how much the market has factored in but a consensus that the latter 2 options will cause a further drop. The consequences of future oil prices are complex. The commodity economies , particularly Canada will feel the effect. The US economy will enjoy the lower prices and they will provide a balance to the strengthening dollar. But the weight on the recovery in the global context and the effect on inflation figures will be significant if prices fall further.

Speculation has been rife for a few weeks, tomorrow will tell whether it favours bulls or bears and it is not a time to be risk-exposed .

Other Important data this week.

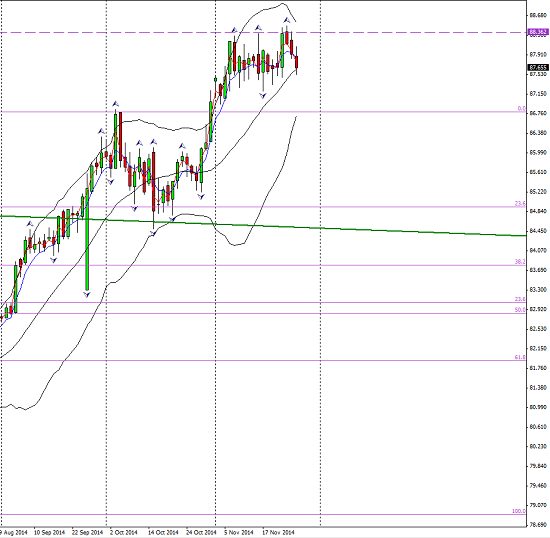

Every week brings a mixed bag for the US and this week is no exception. GDP expanded beyond the expected number which points once again to a slow growing economy. Consumer confidence, however missed as did employment numbers. The labour market is closely followed by the FOMC Chairwoman Ms Yellen so the market watches too. The index is pulling back from its highs reached only last Monday. Any weakness will add to the correction which is still within a range one could describe as a consolidation. Here is the daily chart.

With so much important news around it is becoming more and more important to monitor the Index as well as individual pairs. New home sales , another inflationary imdicator also missed the mark.

After Draghi’s soothing words on Friday, and the Euro’s impressive free fall, it has staged a Three day recovery, but watch that daily trend line for clues and remember the solid trend in the weekly now in consolidation. When there is big news around it is even more important to watch the longer time frames. Fundamentals for the Euro and the USD have not changed and now patience is key. This is what the weekly slide of the EURUSD looks like.

Take A Break

Take A Break

There is more news to watch this week outside the action, (or non action as we shall see soon enough) in Vienna. Eurozone CPI (inflation again) and Canadian GDP as well as Kiwi confidence. We have 4 days of Thanksgiving to digest information as well as turkey.

And lets close with a holiday conundrum….when is an elephant not an elephant? When it is a bull or a bear….or maybe when it’s a turkey. Happy Thanksgiving!!

Judith Waker

0 Comments