Hi everyone

Hope you all well and healthy.

…………………………………………………………….

The top bull and bear pairs using the strength indicator on the 4 hour chart this week will be……..

…………………………………………………………….

…………………………………………………………………………..

The bear pairs to keep an eye on will be…….

…………………………………………………………….

1) GBP/USD on the 4 hour:

The direction indicator is SHORT on the 4 hour and short on the DAILY CHART and we closed MIN 79 pips lower than last week’s opening – so we did meet ALL of the requirements to fib the 4-hour chart for this week’s Earth and Sky trading zone.

Currently I have a short zone between 1.1775 and 1.1833

Areas to keep an eye on: 1.1775 and 1.1838 and 1.1833

Target: WS1 at 1.1671 and WS2 at 1.1600

Counter longs from the WS1 at 1.1671 and WS2 at 1.1600

Target: WPV at 1.1786

Notes:

If price makes a lower low without the correction we wanted….follow price with the fib to get the adjusted short zone for the week.

If we break the 75% fib for some reason to the upside then re look at last weeks high at 1.1901 and the EMA`s between 1.1970 and 1.2006 for resistance to short from as the main trend is still short.

…………………………………………………………….

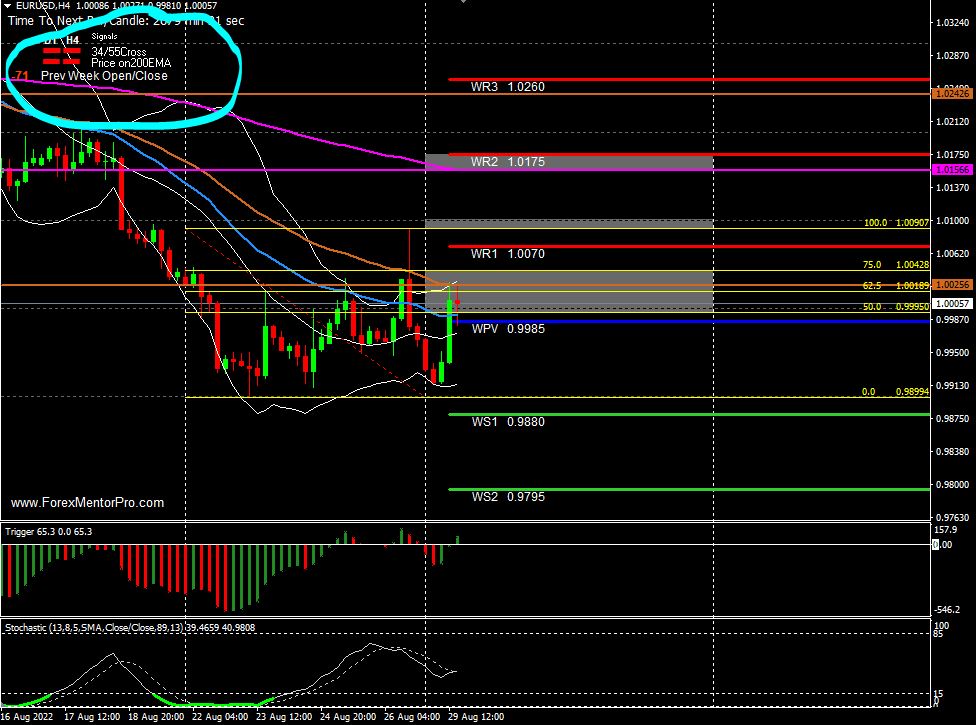

2) Euro/USD on the 4 hour:

The direction indicator is SHORT on the 4 hour and short on the DAILY CHART and we closed MIN 71 pips lower than last week’s opening – so we did meet ALL of the requirements to fib the 4-hour chart for this week’s Earth and Sky trading zone.

Currently I have a short zone between 0.9995 and 1.0042

Areas to keep an eye on: 0.9995 and 1.0018 and 1.0042

Target: WS1 at 0.9880 and WS2 at 0.9795

Counter longs from the WS1 at 0.9880 and WS2 at 0.9795

Target: WPV at 0.9985

Notes:

If price makes a lower low without the correction we wanted….follow price with the fib to get the adjusted short zone for the week.

If we break the 75% fib for some reason to the upside then re look at last weeks high at 1.0090 and the EMA`s between 1.0156 and 1.0175 for resistance to short from as the main trend is still short.

……………………………………………………………

3) GBP/Aussie on the 4 hour:

The direction indicator is SHORT on the 4 hour and short on the DAILY CHART and we closed MIN 172 pips lower than last week’s opening – so we did meet ALL of the requirements to fib the 4-hour chart for this week’s Earth and Sky trading zone.

Currently I have a short zone between 1.7069 and 1.7142

Areas to keep an eye on: 1.7069 and 1.7105 and 1.7142

Target: WS1 at 1.6894 and WS2 at 1.6761

Counter longs from the WS1 at 1.6894 and WS2 at 1.6761

Target: WPV at 1.7055

Notes:

If price makes a lower low without the correction we wanted….follow price with the fib to get the adjusted short zone for the week.

If we break the 75% fib for some reason to the upside then re look at last weeks high and the EMA`s between 1.7216 and 1.7283 for resistance to short from as the main trend is still short.

……………………………………………………………

The bull pairs to keep an eye on will be……

……………………………………………………………

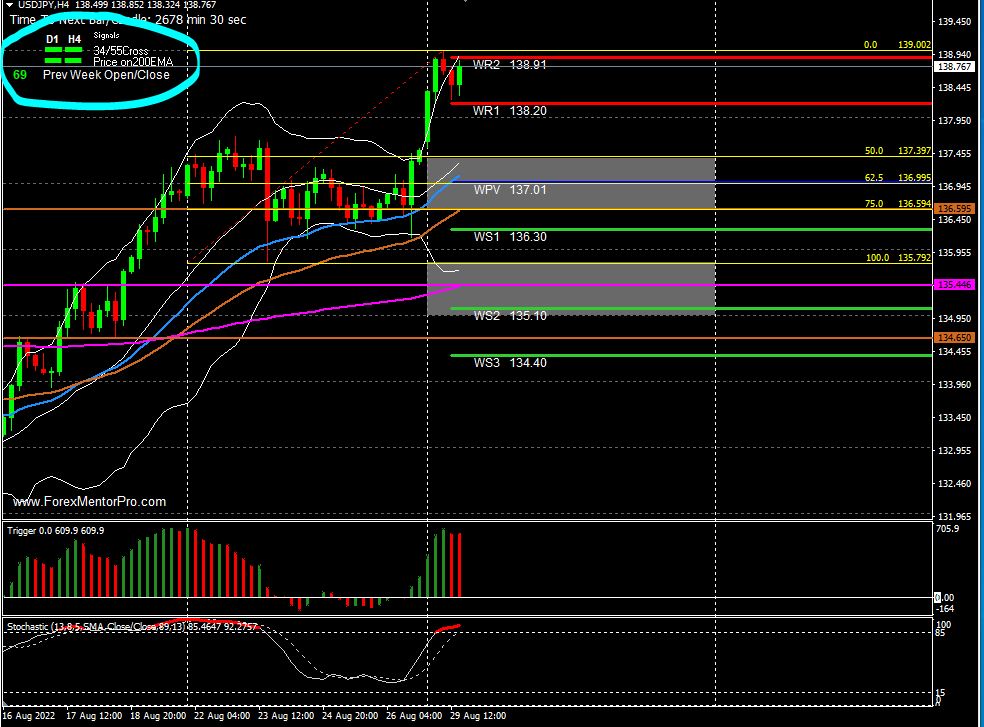

1) USD/JPY on the 4 hour:

The direction indicator is LONG on the 4 hour and LONG on the DAILY CHART and we closed PLUS 69 pips higher than last week’s opening – so we did meet ALL of the requirements to fib the 4-hour chart for this week’s Earth and Sky trading zone.

Currently I have a long zone between 137.39 and 136.59

Areas to keep an eye on: 137.39 and 136.99 and 136.59

Target: WR1 at 138.20 and WR2 at 138.91

Counter longs from the WR1 at 138.20 and WR2 at 138.91

Target: WPV at 137.00

Notes:

If price makes a higher high without the correction we wanted….follow price with the fib to get the adjusted long zone for the week.

If we break the 75% fib for some reason to the downside then re look at last weeks low and EMA`s between 135.79 and 135.10 for support to long from as the main trend is still long.

……………………………………………………………

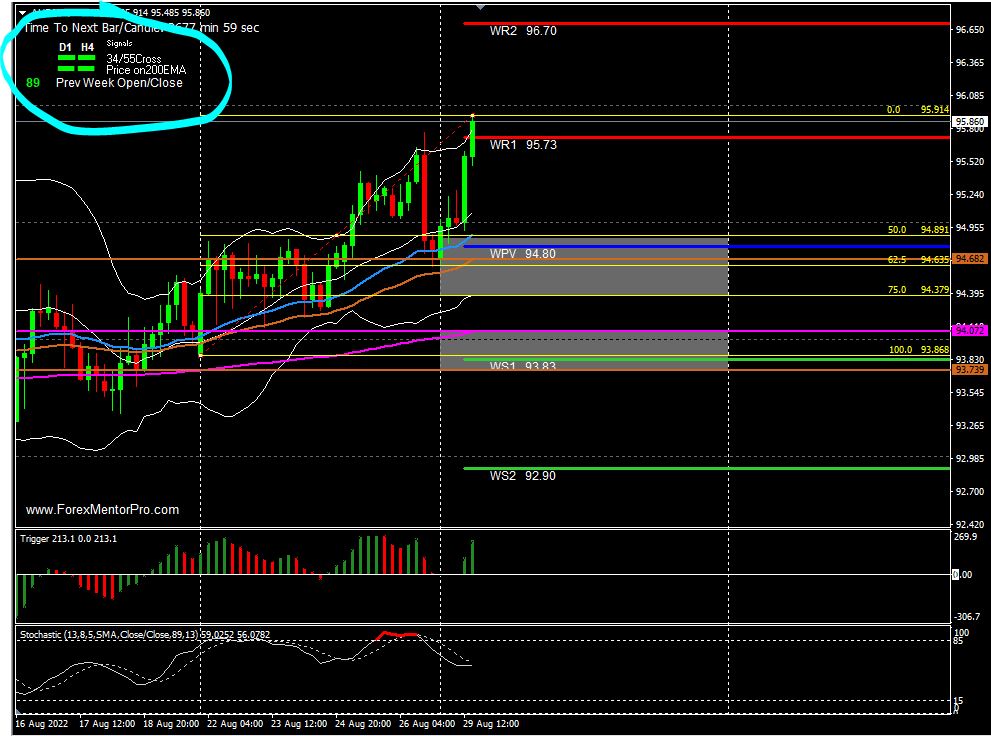

2) Aussie/JPY on the 4 hour:

The direction indicator is LONG on the 4 hour and LONG on the DAILY CHART and we closed PLUS 89 pips higher than last week’s opening – so we did meet ALL of the requirements to fib the 4-hour chart for this week’s Earth and Sky trading zone.

Currently I have a long zone between 94.87 and 94.37

Areas to keep an eye on: 94.87 and 94.62 and 94.37

Target: WR1 at 95.73 and WR2 at 96.70

Counter longs from the WR1 at 95.73 and WR2 at 96.70

Target: WPV at 94.80

Notes:

If price makes a higher high without the correction we wanted….follow price with the fib to get the adjusted long zone for the week.

If we break the 75% fib for some reason to the downside then re look at last weeks low and EMA`s between 94.07 and 93.73 for support to long from as the main trend is still long.

……………………………………………………………

Regards

Pierre

0 Comments