Last week Judith made 788 pips form 3 trades ALL based on a combination of fundamental (global macro) and technical analysis.In the Oxford English Dictionary, the word integrity has two different definitions. Firstly it is ‘the quality of being honest and having strong moral principles’ and the second is ‘the state of being whole and undivided’.

On both meanings, it seems irreparable damage has been done to the integrity of the Eurozone, the European Union and now what we have all come to see as the Troika. I prefer the un-elected gang of three.

With an about turn by M. Lagarde who all too late admitted debt restructuring (which includes the option of reducing) was an absolute necessity for any chance of the Greek economy recovering, and the German Finance minister, sham artist- Schaueble, continuing to resist the idea as ‘illegal’ , the idea of a united Europe is quickly slipping back into recent history.

EUtopia Lost

Indeed, it is perceived now there are a growing number of people who now think its just a question of time.

As Bernard Bernanke, the former chairman of the FOMC observed, ‘…current economic conditions are hardly building public confidence in European policymakers or providing an environment conducive to fiscal stabilisation and economic reform; and European solidarity will not flower under the system which produces such disparate outcomes among countries’

It may well be that the German striving for control has nipped it in the bud completely. Against this background, the zone is struggling to get an inflationary foothold partly as a result of the stubborn adherence to austerity measures. It was a fragile bud to begin with.

Be that as it may, the Greek parliament have accepted the bail-out measures in principle and are once again ready to take up another mantle of debt although this all proceeds another round of potentially charged debate to thrash out the details.

Of course, we have discussed the GDP effect on the Greek economy with unemployment among the young at unacceptable levels.

Germany has engineered a powerful position within the zone, with their emphasis on exporting to as opposed to importing from their neighbours, this resulting in imbalance with the the Germans holding a trading surplus against their southern neighbour’s deficits.

Little surprise that they do not have the same employment problems and the southern part of the zone;

Draghi is behind the concept of increased emergency aid and banks may re-open Monday. After that we are back into the realms of uncertainty, and no post-deal elation is enough to counter the effects of sagging inflation (again) and continuing bulk buying of bonds under the QE programme.

With all the smoke and mirrors of the Greek crisis, EUR CPI crept in on expectation but still an unimpressive 0.2%. With oil prices set to decline further the pressure will continue to inspire some inflationary growth.

The Euro in steady decline all week now rests on a critical level of support just above 1.08. With a down bias a break and hold is a selling opportunity.

The Sentiment Barometer

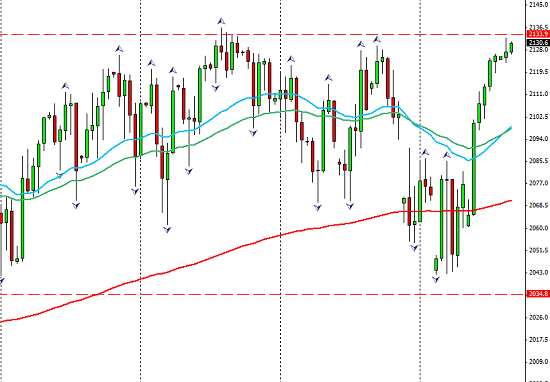

Firstly the S&P. A lot of talk this week about US equities striving for new high but the bigger picture established range is still in control. Just.

Geo-politics have had a big influence on sentiment but this week has seen a dousing of some of the nerves as risk appetite returned. We have spoken before about assumptions. They are dangerous and as we trade the risk-on environment we should not discount it’s fragility or it’s fickle nature.

The Bond market.

This one showing buying towards the end of the weaken Europe and the UK but still selling pressure on the US 10 and 2yr treasuries pushing the yield up slightly, following expectations of a growing likelihood of a rate hike this year. This weekly perspective so any signs we saw of risk aversion not apparent here.

The VIX and VStoxx

Last week there were definite signs of anxiety and fear. There is a very different picture at the close the week.

The Sentiment Pair

AUDJPY, this too reflected the move back towards risk and the resumption of the search for yield. t is however in an interesting place.

The Iran Effect

The outlook for oil took another step down last week as the historic deal on nuclear programs was reached with the US. This is a major development not just for the oil market but for focuses to shift on a global bases. There will be some interest from Europe as sanctions and trade embargoes are lifted. This will take time to put into effect but the market has reacted as one would expect.

Fracking continues apace in the US as it establishes itself as the worlds biggest crude producer and more bad news for oil prices is the pending legislation in the US to end the export ban imposed back in 1975 when threats of Middle East Oil embargoes combined with scarcity concerns prompted the ban. The bolstering of current production would be an expected outcome should the effort succeed.

The bias is down with pressure building on our commodity countries even further. There is also the threat of deflationary pressure at a time of fragile global recovery.

The China Effect

The intervention explored in last week’s blog did not prevent another push down in the Shanghai index, recovering in the second half of the week but a down bias none-the-less;

In view of the extent of the interference and the imput from Chinese state owned banks that has revealed itself in the last few days, this is disturbing and potentially damaging not only in terms of the underlying weakness of the leveraged equity markets but also in terms of the confidence of the international investing community and the lost credibility. There is also the question of the inclusion of MSCI’s global Index of emerging markets. The way in which the rout was handled could be a fatal blow to their inclusion even though it was indicated earlier this year that it was likely in the next few years. That now looks much more difficult to achieve.

Either way, the events of the past few weeks have done little to raise the spirits in the Chinese importing markets such as Singapore, or the commodity countries discussed below.

Back To Economics; A Review of Current Global Comparatives;

Not a week without notable policy events and there may be more to come with rumours of a cut also in the Kiwi in Wednesdays expected rate announcement.

Don’t mention the Recession

Big news came out of Canada this week with the second rate cut of the year. The Chairman of the BOC sorted round the ‘R-word’, expressing his view that it was unhelpful. The fact is that the January cut was suppose to promote growth and it is now clear to all that this did not happen.

Big news came out of Canada this week with the second rate cut of the year. The Chairman of the BOC sorted round the ‘R-word’, expressing his view that it was unhelpful. The fact is that the January cut was suppose to promote growth and it is now clear to all that this did not happen.

Yield curves have in fact been inverted for a while, only slightly but the further out bonds yields have been lower than the near end. That spells the big recession warning. The other problem is that a housing bubble has formed encouraged by the lower rates and household debt is rising.

With even more pressure from falling oil prices, already down 18% in five months and no respite in view, it should not be at all surprising that the IMF lowered growth forecasts further.

The Dairy Tank

The word on the street isn’t so much ‘if’ but by ‘how much’ the RBNZ will lower rates in the meeting on Wednesday.

The word on the street isn’t so much ‘if’ but by ‘how much’ the RBNZ will lower rates in the meeting on Wednesday.

Dairy prices fell badly again on Wednesday, average price of dairy products falling to -10.7%.

The Kiwi fell to 5 yr lows against the USD not just on the gloomy outlook but on improvements in US economic data and more hawkishness from the FOMC.

It suffered against the GBP and the Aussie dollar. How much of an expected cut is now factored in remains to be seen but we can expect volatility and hopefully a pullback for further shorting opportunities.

Back Down-Under

Pressures continue on the Aussie dollars Chinese markets failed to respond to market intervention by the government. Commodities and iron prices will pile on the pressure as will the more positive US prognosis.

This is a resource reliant economy and as with its neighbour may well have to create new GDP areas to develop as these pressures look likely to continue.

The Race to Raise

Dr, Carney retook the stage and put even Chairwoman Yellen’s hawkishness in the shade. He has indicated the likelihood of a rate rise in the near term which of course sent speculators off on the question of when with February 2016 as the favourite but an outlier chance of this year. The only note of caution from the BOE chairman was that ‘economic shocks’ can effect the trajectory and that the BOE will ‘fealties’ way’. Thus we have as much guidance from the good Dr. as his counterpart in Washington will give.

The shortfall in inflation targets was discounted as a direct and temporary effect of a fall in commodity prices and of course that includes oil. The rates and the raises will reflect the gradual firming of inflation trends. At least that is the plan.

Data failed to follow through, with core CPI missing slightly and average earnings down also by a small amount (but still the wrong direction) alongside an increase in unemployment.

The effect on the GBP from Carney’s statement was, however, impressive especially against the weaker commodity currencies. Here it is on a daily chart against the NZD;

The Eagle Eye on the Fed

Janet Yellen echoing the UK tone and feeling the mood, reaffirmed the possibility of rate rises this year. The USD index rose on the news

As always data data data…if the economy improves there will be a rise this year but she is still looking for greater confidence that inflation targets can be met and that the labour market continues to improve. Ms Yellen always has a word of caution even in her more hawkish moments!

Meanwhile the IMF lowered US forecasts as well.

Abenomics (continued)

In Japan, the 80 Trillion yen per annum easing program continues but inflation outlook has just been cut by the BOJ. Consumer spending has weakened as have exports ;

images courtesy of www.tradingeconomics.com

It will take another venture into risk aversion to maintain recent JPY strength.

IMF forecasts also cut here.

The Week ahead

Monday; CAD wholesale sales, but focus on Aussie minutes

Monday; CAD wholesale sales, but focus on Aussie minutes

Tuesday, AUD CPI..and inflation number, with a statement from Stevens.

Wednesday; GBP votes, and NZD rate announcement

ThursdayGBP retail sales (another important inflation indicator) Same in CAD and the US employment numbers, NZD trade balance and Chinese PMI

Friday; PMI from the Eurozone.

Divergence and Sentiment

The theme of divergent monetary policy and of economic standings and data is likely to continue into the new trading week and it was clear as the last trading week closed that the market had returned its attention to economics and the global comparatives but that does not mean we should not pay attention to sentiment going forward. In fact the shifting too and fro only renders it more important.

The theme of divergent monetary policy and of economic standings and data is likely to continue into the new trading week and it was clear as the last trading week closed that the market had returned its attention to economics and the global comparatives but that does not mean we should not pay attention to sentiment going forward. In fact the shifting too and fro only renders it more important.

With the Greek situation not yet over not to mention the ramifications for the rest of the zone and the possibility of a deferral of a state of crisis rather than a solution, and with China posing a whole new set of threats to global economic stability this is no time to rest on our laurels not wishing to imply any ‘honour’ in anything ‘achieved’ by recent politicking.

As for integrity it seems a impossible dream. Unity with shackles, is not unity and is not sustainable or of any value. When a price is attached it is nothing more than a sham.

Judith Waker

788 Pip Profit From Global Macro

0 Comments