With Janet Yellen on one side confirming her intention, admittedly with the usual set of warnings, to continue the tightening path and on the other side both financial gloom on global growth prospects and geopolitical clouds gathering, it seemed as if the market put their hands over there ears and partied on.

Strange divergences in opinions and in correlations are appearing and have been noticed by the financial media if ignored for now by the market itself and we should pay attention as they could well be casting a serious warning. Indeed, if the market has noticed, has it reached the stage where it simply does not believe anyone?

And just how can we trust QE when it has delivered ‘a whole lot of nothing’ Of more interest why is the market so ready to absorb such news?

Profiting From Nothing!: The Fed Debacle

The fact is now the prospects of a rate rise in the US have increased significantly in less than a month. OK so they are still assessing risks but they see gradual and cautious moves on the rate as a reality.

They have seen signs of growth and expect economic improvements; it is true that GDP which was on our calendar watch list this week and it was revised up to 0.8% but it osn’t that impressive. Yellens focus is on job stats but lets see what PMI from the ISM tells us this week.

In her speech Friday, Chairwoman Yellen seemed only concerned about a steep rise in interest rates which could stifle the new recovery at home. The global concern is quite different .

As to the reaction on Friday, both the S&P and the USD index advanced into the close. That it noteworthy. True that the financial sector will see their future optimistically if the Fed pursue their path as low rates has been a real problem hindering profits, but for the S&P to finish on a high with the USD we see a major correlation break;

The Yield on the 10 year US bond looked less excited

European stocks raced away as well

Another broken correlation as the bond yield in Germany looks like this

The PMI statistics from the EZ saw another slip in manufacturing and particularly worrying is France who are well into contractionary territory.

There is no doubt that any move the Fed makes is a global event . Even if the US seem upbeat as to their own recovery, whether or not you agree with their stance, it does not follow that the sentiment will be positive.

The knock on or rather In some emerging market cases, knock out effect of higher rates is more likely to add pressure to the global lean towards deflation. The battle is far from won even if Obama sees signs of improvement in Europe in his post G7 summary, and he certainly forgot to mention recession in Japan.

Profiting From Nothing!: The Outlook for Crude

The situation the the Middle East would suggest that the price will struggle where it is. The Iranians are determined in their bid for pre-sanction levels. The US could come back from their Saudi inflicted closures once the price hits a reasonable level. The Saudi’s have also inflicted a deficit problem on themselves and are looking for creative solutions. A real own-Goal!

The bias is still against a sustainable rally from this point. Different scenarios should always be considered as the market has on many occasions taken us by surprise, but signs of weakness here should be monitored as it could lead to more and fast shifts in sentiment for which we must stay ever vigilant in current market conditions.

Profiting From Nothing! : Risk Assessment

The VIX confirms the risk on mood

It is one to watch as we look to see if the S&P weakens from its current highs. With the fundamentals still not showing any support for a sustainable equity rally, I am still looking for signs of weakness rather than strength. With the correlation broken, one side will have to give and it was noted in the media that the USD index’s finish into the close was stronger than the S&P–

As it is, we have a bank holiday in the US and in the UK tomorrow (Monday) so we may see a loss of momentum and follow through for the greenback. It might be an idea to keep the powder dry on Monday.

There is one currency pair regarded as a litmus test for sentiment . The AUDJPY is in an interesting pattern and certainly for the watch list for either the weakening of the JPY or the risk climate shift to the downside:

Risk has, as we know become a day to day issue and last week’s fizz should be taken in that context. There are major weak points to undermine any consistency in the mood of the trading community.

The final point to make on sentiment is Japan itself and to remember from their comments and concerns openly expressed at the G7 , if we do see a risk off strengthening of the JPY, we may see an intervention whatever the global economic community has deemed as appropriate behaviour. That we must also stay alert to.

Profiting From Nothing!: The Week Ahead

Bank Holidays in the US and the UK on Monday, despite this a little Fed speak from Bullard, retail sales in Japan and German CPI

Tuesday: Aud building approvals, CAD GDP, that’s a major stat to watch and any weakness could give the USD some movement. Also core PCE in the US.

Wednesday, critical Chinese PMI, one to watch even if it isn’t reliable it is a market mover and a sentiment factor. Caixin is independent so keep an eye on this.

Also GBP PMI (manufacturing) can cause waves, and the USD ISM manufacturing PMI. This is a major stat.

Thursday will see AUD retail and trade balance, UK construction PMI, Opec and the ECB. Quite a list. Crude inventories and ADP non-farm from the US makes this an eventful day.

Friday, non-farm and for many non-trade day! Watch out for average earnings and ISM non manufacturing.

Opportunities

Pitfalls and catalysts abound so it is a week to stay on our toes. Follow through for the USD may be hampered with such a full diary and a public holiday. Sentiment is always a necessary ingredient to choosing pairs.

I am still looking and waiting patiently for equities to show weakness but we need a good pattern before that is ready for positioning. Gold longs will be on the radar if the risk off mood takes a grip. Certainly it is at levels which could be fruitful if the underlying conditions support it.

The GBP is interesting in terms of patterns and the fact that it lost a lot of ground on Brexit fears and perhaps an overreaction in the cross pairs particularly. Brexit fears have subsided but with only three weeks to go, this could be uncertain and volatile. It is still on the radar with the patterns it offers.

The longs of interested in the USD are against the commodities looking precarious

And the emerging sector ahead of the Fed

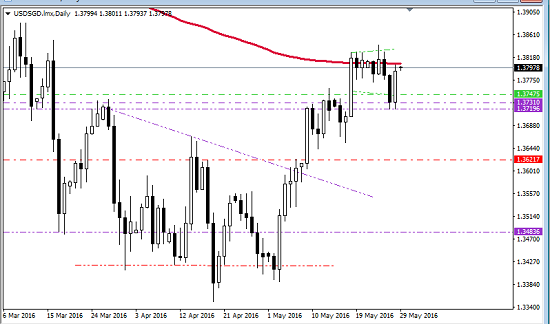

USDSGD

June has the delights of Opec, lower volumes which can cause its own brand of confusion , The Fed decision and the UK Brexit referendum. We are not short of gunpowder for some interesting outcomes.

The market awaits the Fed decision with now heightened anticipation not to mention trepidation and we can be sure that this is the major theme that will ultimately direct market sentiment and thus our decision making processes. Needless to say it pays to take notice.

There are some good reasons to reduce the time exposure in our trading positions, avoid some volatile areas and even better reasons for the discipline of risk control. If that criteria is met then patience can bring profit.

Judith Waker

If you would like to learn how to trade like a professional check out our 5* rated forex mentor program, RISK FREE; by clicking on the “Get Started Today” Button below

0 Comments