Here is the line up for 2015:

Yellen, Draghi, Carney, Tsipras, Putin, Merkel, just these alone (and there are many more) in a melting pot that is becoming increasingly volatile provides the trader with enough uncertainty to expect the unexpected.

The Central banks are in a race to devalue currency in order to fend off a global deflationary threat but their motive includes being competitive with each other and thus partaking of what seems to be developing into a devaluation spiral.

The consequences of global connectivity spills over into what has been described as a currency war and a very far cry from the global co-operation called for by Christine Lagarde in January’s Davos meeting.

Then there is the USA. Preparing for recovery but delicately managing language in order to factor in their own concerns of this new financial world disorder.

The market seemed to ignore the possibilities of chaos from the Greek quarter following the election, piling into Euro stocks on the back of the QE announcement .There was also a noteable rush to quality bonds in the US and in Europe, pushing yields lower.

Amidst all the drama that included an FOMC statement it was also of note that USD index did not fall on the warnings of ‘patience’ and the prospect of deferring rate hikes until 2016. In fact it edged up at the beginning of the week, ending just a little down.

The market this week showed us visible signs of confusion and fear. These two are common bed-fellows and the sentiment continues to shift in their direction.

Is it or isn’t it? The FOMC Statement;

‘However, if incoming information indicates faster progress toward the Committee’s employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.’ Patience is certainly a trader requirement !

Erring to the hawkish they ‘expect inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate’. At least they are clear in their anticipation of energy prices not derailing their recovery and they were clear with their goal of full employment and 2% inflation. No surprises there.

The confusion in the market place showed up as the USD index held its high ground;

Meanwhile bonds without the same optimism and no obvious perception of new hawkishness from the FOMC, saw the yields fall further. Of course there are elements of European QE affecting the US treasuries, but still it wasn’t seen as an optimistic rate hike outlook from the bond market perspective.

The Greenback may be reaching the upper value levels when weighing all the factors from the US economy, but as we know it is not just about their own data. It remains the shining light in a dim view of global growth and comparisons will continue to be made and may well take the value higher.

European Politics

Whatever your political persuasions it is becoming increasingly obvious that it is developing into a situation of ‘each man for himself’ and less and less a sense of unity which is the only thing that will bring the Eurozone together in a geographical as well as a fiscal sense. And in this context Carney is spot on . As Germany resists it becomes apparent that they are not acting for the good of the union.

There is at least a calm beginning to the negotiations with the new Greek administration but the opportunities for debt ‘reconstruction’ are limited except in the deferring of payments. The debt forgiveness that the Syriza party demanded before the election is now well beyond the line drawn by Merkel and co. The 226 billion received in Greece went to bail out the banking sector (which allegedly comprised mainly of French and German Banks), only 27 billion reached the Greek State. The majority of the loans were not to aid the Greek people or to revive their economy. There is little hope of meeting payments as things stand and the uncertainty and the speculation will continue as long as the negotiations . The EU is holding a potential time bomb.

How the big news is playing out

The market evidenced at least the ECB’s efforts to bring liquidity to the zone. Now with three strong weeks for euro equities, despite a pull back late last week they have seen their best month’s moves for three years.

This is in marked contrast to the S&P 500 which has seen 2% loss since the the new year began;

Form a technical aspect and with a eye on sentiment shifting as it is to increased fear, it is looking decidedly precarious.

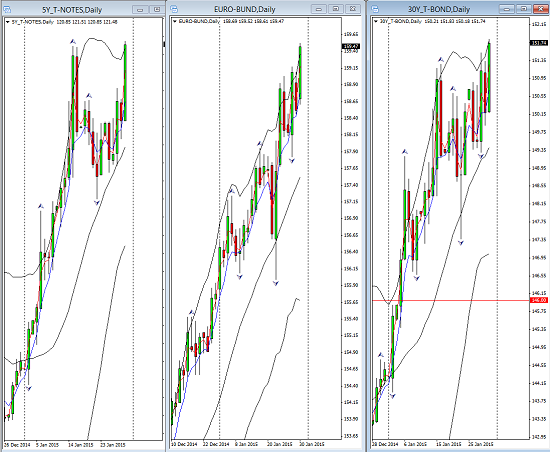

The bond markets have seen rallies in both US treasuries and European bonds;

The yields have of course been pushed lower, the dax now at a record and astounding low of 0.31.

Compare this to the US 10 year note. This refused to rise on the statement which the Fed released last week despite what some perceived as a buoyant tone. It is true it is drifting lower but the in comparative terms it is still at 1.67 and healthy compared to it’s European counterparts;

The Euro may be under pressure again, despite recent rallies. Here seen against the USD on a daily chart;

The US saw a dip in advance GDP at 2.6% and then unemployment data also came in Friday afternoon with a very strong number exceeding expectation with with claims falling to 265K

In New Zealand this week, the central bank changed its stance from raising interest rates to neutral echoing a global dovish trend which is gaining momentum. It saw the NZD dollar fall against the USD to a four year low and brings the intimation that rate cuts may be possible to counter deflationary effects.

The anxiety spread to the Aussie dollar as the market anticipated the RBA decision. The rate was indeed cut to 2.25% and the Aussie fell on the news.

In terms of sentiment the VIX headed up again last week. Keep watch on this should the S&P index break to the downside.

The Week’s Fundamental Watch

Following sentiment is now essential going forward. It is hard to see how fear will not increase in such a market where the year has started so dramatically in terms of global macro events. Looking at the US dollar from a perspective of index and its technical length and height one could expect a pullback. From a fundamental view, data and growth is slowing and there is concern , and not just in the bond market, about the effect of the crises seen elsewhere and in particular in the Eurozone. One might expect to see a leveling off at its current value as these factors take their toll.

This is however the only recovering economy and continuing risk aversion will bring buyers back to the USD.

Can the USD push higher? The ECB certainly hope so as they look for a cheaper Euro to come to their aid and with the doves adding to their numbers each week in other global central banks, they won’t be alone.

Non-farm Friday this week so a day to stay away from the trading desk ..this is a big market mover.

Plenty to digest and monitor, and when all is said and done , there will be short opportunities in the Euro, especially against the USD and the JPY and also in the Aussie. We could yet see Euro and USD parity. There are plenty of opportunities ahead but stay aware of the ever important risk environment.

Safe and successful trading with the global macro edge!

Judith Waker

0 Comments