Oil, China, Monetary Policy. The driving gang of three. Draghi spoke, Carney spoke, oil rebounded and equities. But which came first and what drove what and does it matter? We operate in a highly correlated and interconnected market place and this year we have swung from crises to recovery in shorter and shorter time frames. Gloom and doom at the beginning of the week gave way to a happy rally into the weekend. Sentiment is all we need to understand but that is now no simple task and it can change on a dime, or on a euro for that matter. It no longer needs a month but a few hours to launch into a different direction. The market is choppy unpredictable and fear ridden despite any optimistic rays cast at week’s end.

So if we know what to look for do we know what to do with it? We will take a look at each of the big three and how they may be affected by the major news week ahead.

Chicken Or Egg?: Crude Arguments

Oil remains the major theme. The latest rally may have been helped by the severe winter conditions across the Eastern US, but this week has seen warnings from the IEA of the oil market ‘downing in oversupply’ . With an oversupply of 2 million barrels per day and Iran ordering an increase of 500,000per day following the lifting of sanctions, the producing countries are in for more pain. The Saudi effort to suppress the US supply may be working as rigs fell again by 5 to 510 from 1317 this time last year, but it has come at a big price.

Venezuela are pushing for an emergency Opec meeting to discuss stemming the losses and controlling production and not surprisingly Iran are opposing it.

It has also had an interesting effect on equities used to hedge against such a crisis by the producing nations who are now dumping assets to fill the revenue gap. So it is not just fear that has crept into the globes major stock exchanges since the beginning of the year.

The oil chart for crude seen on a weekly perspective does not look as optimistic as Friday felt and with strong resistance above and the fundamentals still set against any sustainable rally;

Chicken Or Egg? China

We were risk on as the week closed and by Monday afternoon back into risk off. It needs careful watching.

Chicken Or Egg? Lower For Longer

The same message from Mario Draghi and Dr. Carney this week. Whilst Carney takes some flack for delaying any start in a tightening cycle, his reasoning is the same as Draghi, with a stock market rout in the first few weeks of the year and tumbling oil threatening the inflation target again, not just in the UK but globally. Draghi promises again to do what it takes…lets not forget he promised that last year and ended up seriously wrong-footing the market in November. Can we trust him if German resistance continues?

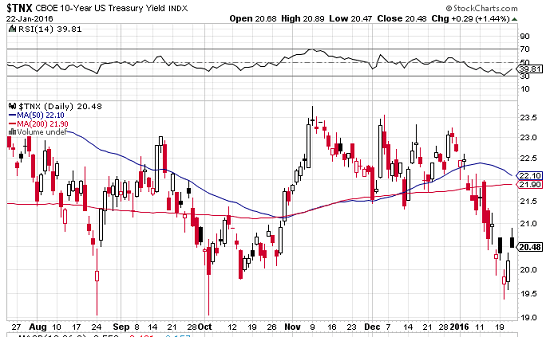

And what of the US? The FOMC have painted a much rosier picture than the bond market who have priced in one rate hike against the fed’s four. From where we stand the Bond market looks to be much closer and this week we get to see if Yellen and co get on the back foot with their monetary tightening policy. Here is the US 10 Year yield courtesy of stockcharts.com

Inflation has increasingly challenging headwinds and the equity markets may well have read in from Carney and Draghi that the only option for central banks is not only lower for longer but more of the same. That could explain Friday’s ebulliance. Bearing in mind the trillions thrown in to date around the world have done little more than scrape inflation above zero, promises or even action might not quell fear for very long this time.

The week ahead will provide a whole heap more policy, from the US from Japan and from New Zealand. It could be another wild ride. The language for sure will be closely watched for clues and projections.

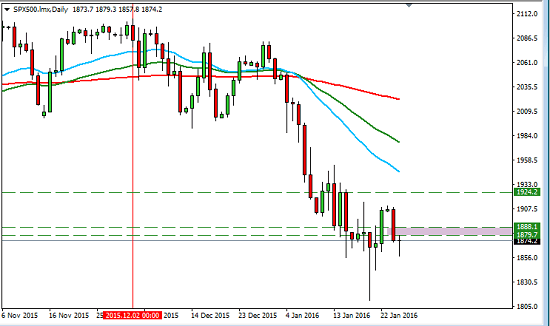

Does A Dead Cat Bounce?

The S&P 500 chart tells the story:

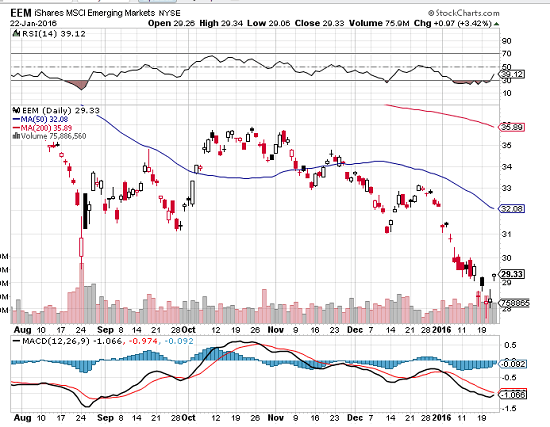

The emerging markets also enjoyed a bounce

Catalysts and the Week Ahead

Draghi and Carney are both speaking again Monday and Tuesday respectively. AUD CPI an inflation indicator is also on Tuesday.

From Wednesday it get seriously dangerous! The Fed rate and more importantly the statement is a major catalyst, to see if the fed are closing their eyes to global; concerns or if they too are about to soften. The RBNZ make their decision the same day and their tone is also important. They have trade balance and we also wil see retail sales in Japan.

Thursday the drama continues with US durable goods and unemployment stats and the rate decision and statement from Japan.

If that isn’t enough for one day we will also have UK GDP as well.

Friday, no let up, advanced GDP from the US and GDP from Canada and Spain with EZ CPI data as well.

Plenty there to set the cat among the pigeons, if he isn’t dead that is!

Risk Environment

A day to day assessment with swings to be expected with the week we have ahead. The market closed with solid evidence of appetite but it cannot be assumed. It is a nervous environment and therefore a sensitive one. If risk on returns we trade with it but always alert to the possible shifts. Tight risk control and even shorter term time frames may work better. I am still watching the JPY for short opportunities. In the meantime the EURUSD shorts and the EURAUD on the Draghi initiated expectation of central bank support, but only if risk off doesn’t re grip and it did seem to return after oil strarted to fall again on Monday . Also waiting patiently for pullbacks in the USDCAD and the USDSGD for longs. The EURGBP was on our list for a short had the risk on environment lasted longer

There are major levels to watch, including this monthly double top in the USDJPY. The S and P has already visited weekly level.

We have a potentially explosive week ahead. Sentiment as always is the key and not wise to trade against it. What moves first and what affects what is a phenomena to watch but one thing is for sure, it will take the oil market to stabilises, before the equities and the wider financial markets are able . Sustainable rallies are not worth considering until we reach that plateau. Until then be alert to more volatility more uncertainty and even suicidal felines.

Judith Waker

If you would like to learn how to trade like a professional check out our 5* rated forex mentor program, RISK FREE; by clicking on the “Get Started Today” Button below

0 Comments