Well the week started out predictably enough, not that we can ever describe the market as predictable. There was a lot of sideways movement, waiting to see that the FOMC had to say in the minutes of their last meeting released on Wednesday afternoon.

It was on everyone’s calendar.

It ‘s effect was muted as we shall see, although the USD/JPY rose to a new high at 118, but then came the triple whammy on friday, Draghi announcing QE sooner rather than later.

China following closely behind within hours with news of a loosened monetary policy and then the BOJ via their finance minister announced the Yen was falling too fast hurting the Japanese stock market on the last day of the trading week and checking the USDJPY back down to 117.71 although off it’s daily lows.

It was an interesting day and for once the USD pairs which seem to move for the most part in perfect harmony like synchronised swimmers began to go in different directions.

Profit from Understanding Policy

Hawks and Doves

Once again the week showed just how Important the policy decisions are and how the market is moved by interest rate rumours, intentions and predictions.

The FOMC kicked off the action on Wednesday, whilst maintaining the ‘considerable’ time clause for rate hikes to begin. It leaned in a hawkish direction in its tone and played down the dangers of a wider global risk of economic stagnation on the USA’s more upbeat recovery.

They saw lower oil prices balancing the foreign trade risks and also saw promising progress in the labour market at home.

Warnings were noted regarding inflation forecasts and the dangers of it dipping below forecasts.

All in all it was a positive report though with dovish undercurrents the effects were a somewhat muted. Advances were seen against the Aussie, the Kiwi and the Canadian Dollar, not so much where the Euro was concerned and the day saw the GBP gaining value against the greenback for its own reasons. The dollar index shows the modest reaction on Wednesday. It wasn’t until Friday that it had its best move for different reasons, closing out the week near its highs.

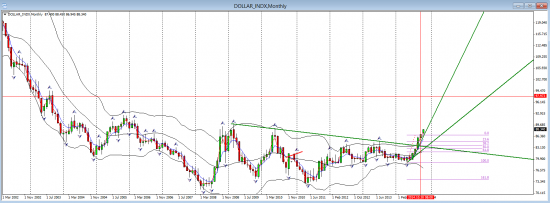

The attitude of the Federal Reserve and the slow progress seen in US data continues to support a gradually strengthening dollar. During the week I drew attention to a reverse double head and shoulders on the monthly chart of the USD Index. The consolidation on the daily perhaps shows an attempt to break upwards that is worth watching but with multiple factors there will be a lot for the market to digest especially in the first few days of the new week.

Draghi the Dove, softened further with his stark warning that action to stimulate inflation will have to be prompt.

The weakness that the EZ is displaying was enough for the ECB chairman to ‘do what we must to raise inflation and inflation expectations as fast as possible’ and that can include the radical step of QE.

The sceptics of course will say that without fiscal reform on a national level it may not succeed but Draghi remains determined to play what may be the only card left in the ECB pack.

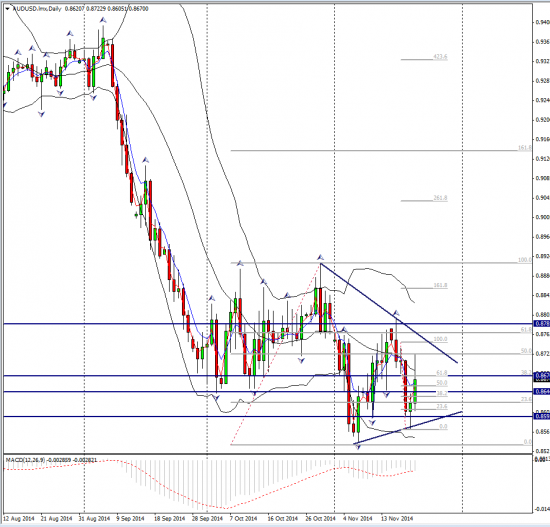

Of course the expectation leans firmly towards a further weakening of the Euro which started rather aggressively on Friday following Draghi’s speech. It is now hovering near to its lows where a break out to the downside would be a shorting opportunity. The daily chart shows a neat pullback to a trend line where the up move halted on the FOMC minutes and then fell as we know, because of EZ worries not USD strength.

The Chinese policy announcement brought more doves into the news cutting interest rates in an attempt to stimulate their struggling growth. The Chinese have of course much tighter controls on the banking sector but are moving towards market forces and the intention is to make more money available to small companies. Economists remain sceptical about the boost taking a marked effect on growth.

The reaction was to send the Aussie on a run-up falling back before the close. It is unusual to see the Aussie go in a different direction to the Euro once again affirming it was not about the USD . Commodity prices have started moving up in the last week and this too was a factor in the gains of the Aussie. Again the digestion of the Chinese news will take a fews days to establish a direction and their is a nice daily triangle to keep an eye on.

Finally and just to round off the weeks unexpected twists and turns the Yen, having been hit by the news of snap elections and a deferral of sales tax as the region slips into rescission, put in a late recovery on Friday on the warnings of Japan’s finance minister that the Yen had fallen too fast. The Yen earlier this week hit a seven year low. He did add that their would be no intervention in the process of the market itself settling the currency’s value.

Profit from Understanding the Fundamental Basics

The Data Behind the Policy

Just putting the rhetoric and the assessment of its interpretation on one side, the weeks data established where the concerns were for the Global Central banks giving some important inflation data with CPI, consumer prices index, and also PMI producer price index. This one we have met before where the level of 50 is the divider between expanding and contracting economies.

With that in mind, Draghi’s move on friday should hardly have been a surprise but his seeming resistance to full blown QE until now had the market doubting the move towards it. Chinese flash PMI data also revealed reasoning behind their decision disappointing as it did and now on that critical 50 level.

Outlook For Commodities

There is no doubt that news from China helped lift prospects for commodities which have now endured weeks of sliding prices. Here is the daily chart,

Does China’s decision really change anything fundamentally? The hope is that demand will strengthen globally for commodities, but questions still remain as to just how much stimulus will produce results . We may be seeing a relief rally, anything else will take a while to materialise.

Take Oil for example, there is still a global surplus and whilst there is a question over the smaller US shale producers and their ability to withstand lower prices, overall production is robust. Opec meets this Thursday the 27th November and all eyes will be watching though few expect the kind of productivity controls that are needed to bring balance back to the Oil market and control the surplus.

Russia and Saudi Arabia apparently agreed last week that oil prices should ‘ not be influenced by political or geopolitical motives.’ I think we can take that with a large pinch of Baskunchak salt!

The Bond Barometer, Neither Shaken or Strirred

Maybe the safest indication of US strength going forward is to check the US treasury bonds. Looking at the 10yr note this week it held a tight consolidation all week with FOMC causing little disturbance.

There remains a lot of information still swilling around the markets that can disturb expectations and at very least invite profit taking so as always, no assumptions can be made.

And there’s More

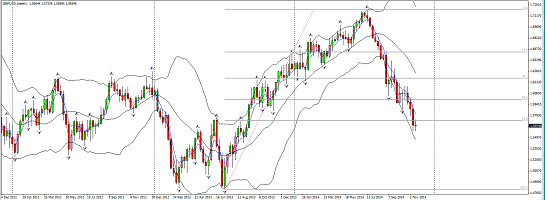

Carney at the BOE, a recent dove speaks again next week. There are 2 members of the BOE who are more hawkish in there views regarding interest rates and the numbers last week were in the right direction. The GBP has fallen to 1.5654 in a downtrend that started in July. It will now be important to watch for any changes in tone or more dissenters to be the catalyst to change this trend.

BOJ’s Kuroda also speaks this week and will be monitored for the follow up in the comments from the finance minister on friday.

On Monday, watch for the SNB. The Swiss Franc peg is pulling the currency down with the Euro so definitely tune in to that.

What stands out from this last weeks news is euro weakness and Mr. Draghi’s fight to save the zone from deflation with an intention to launch QE sooner rather than later.

This maybe will be the provider of opportunity rather than US strength.

Its all down to perspective and staying alert…that is one of the things that doesn’t change in today’s markets.

Judith Waker

how to trade and profit like a pro

0 Comments